Loading...

Loading...

Preserving and Enhancing the Texas Miracle:

Texas Civil Justice League Statement of Conservative Business Principles

by Feb 2, 2023

The Texas Civil Justice League (TCJL) was established in 1986 to work on a bipartisan basis with the state leadership and members of the Legislature on policies that strengthen the business climate and make Texas the best place in the nation to work and live. TCJL has always believed that far more unites us than divides us and that our national and state founding principles can and should direct legislative policy decisions. In the last 35 years, the Legislature has made a series of decisions that have borne fruit in the form of sustained economic growth and opportunity for all Texans. This success has rightly been called the “Texas Miracle.”

The Texas Civil Justice League (TCJL) was established in 1986 to work on a bipartisan basis with the state leadership and members of the Legislature on policies that strengthen the business climate and make Texas the best place in the nation to work and live. TCJL has always believed that far more unites us than divides us and that our national and state founding principles can and should direct legislative policy decisions. In the last 35 years, the Legislature has made a series of decisions that have borne fruit in the form of sustained economic growth and opportunity for all Texans. This success has rightly been called the “Texas Miracle.”

Over the past two decades, Texas has led the nation in business development and job growth by creating an environment that attracts new businesses to Texas and encourages existing businesses to expand. This was not an accident, but the result of positive, common-sense conservative policy principles: freedom of contract, relatively moderate taxes, a reasonable regulatory climate, and a fair and predictable civil justice system.

While the Texas economy remains strong, there are signs of slippage, as CNBC’s ranking of the best states for business, in which Texas fell to fifth, indicates. Much is beyond our immediate control: international crises, worldwide economic headwinds, extreme weather events, pandemic diseases, and widespread social disorder in many parts of the world. But how Texas responds to these challenges is. And with challenges come opportunities.

We can all agree that preserving and enhancing the conditions that produced the Texas Miracle should be a top priority in 2023 and, for that matter, in any legislative session. TCJL believes that the best way to accomplish that goal is to adhere closely to the basic principles that have served Texas so well since 1986. In the first instance, these principles are found in the seminal documents upon which our republican form of government is based and include:

- the separation of powers between the independent and mutually supportive branches of government, as enshrined in the federal and Texas constitutions;

- a federalist system of government that divides powers between the national government and the several states;

- limited constitutional government in which the powers of government are exercised with restraint and in a non-discriminatory fashion;

- the rule of law, which holds all individuals, entities, and institutions equally accountable regardless of power or status;

- freedom of contract between private parties, which permits individuals and businesses to conduct their affairs as they see fit, not as the government dictates;

- freedom of movement of both persons and property, which is fundamental to both personal happiness and economic prosperity;

- respect for the autonomy of free individuals to determine their own futures without fear or intimidation; and

- the promotion of an enlightened and peaceful civil society through universal education and equal opportunity.

There is nothing controversial about any of these concepts, but TCJL believes that we should never take them for granted and that they should explicitly inform all legislative policy decisions. Though reasonable minds may differ about whether a specific policy proposal fulfills or contradicts one or more of the items on this list, simply having that debate in the open and with the full participation of all stakeholders strengthens the democratic process and legitimizes the Legislature’s ultimate decisions. Policies cannot withstand the test of time if they are based on a significant lack of consensus and broad public acceptance. What makes the Texas Miracle so enduring is that the Legislature’s decisions have in great part withstood that test.

TCJL and its members desire nothing more than to sustain and build on the strong foundation the Legislature has laid. The past few election cycles and recent redistricting have combined to produce substantial turnover in the membership of the Legislature. The members in office today, therefore, have inherited a dynamic, robust, and diversified economy that did not exist when TCJL was formed in the mid-1980s. At that time, Texas had the reputation, not as a beacon state for business, but as “the courtroom for the world” where businesses and health care providers simply could not insure their litigation risks. This is why the Legislature’s first steps in restoring Texas’ preeminence as a destination for business involved overhauling the tort liability and workers’ compensation systems. Until Texas had established a fair, stable, and predictable liability environment, no Texas Miracle was even possible.

Building on the Texas Miracle thus requires maintaining and strengthening the liability environment. In order to do that, TCJL engages with the Legislature on dozens of bills every session. We support and advocate for bills that further the goal and oppose bills that we believe undermine it. But before we take a position on particular legislation, we vet it carefully and thoughtfully to ensure that our support or opposition is founded on a clear and specific basis, not because “we just don’t like it.” We thought it might be useful to articulate the steps in our analysis so that, in the event we engage on a bill, policymakers will have a better understanding of our rationale and can take our views into consideration during their deliberations. It is in that spirit that we offer the following standards of review.

- Does the proposal violate the Texas or U.S. Constitution?

The first consideration for any legislation is whether it comports with the federal and Texas constitutions. No one can be absolutely certain of the answer until a court of competent jurisdiction tells us, but it is possible to identify proposals that push up against constitutional boundaries. In this initial step in our analysis, we look closely at the proposal’s potential implications for constitutional protections, specifically those for procedural and substantive due process, the federal and Texas bill of rights, the separation of powers, and the commerce clause. In this regard, we are particularly concerned about proposals that restrict or obstruct the free movement of people, goods, and services across state and national borders. More generally, we ask whether the proposal is consistent with federalism, which for us means comity with other states (for example, does the bill try to regulate conduct in other states? does it seek to retaliate against another state?) and adherence to both the supremacy clause and the independence of the courts to decide the constitutionality of executive and legislative actions. Simply put, bills that raise significant constitutional concerns, especially those that impose or expand the liability of businesses, do not promote a fair, stable, and predictable business climate.

- Does the proposal confer standing on an uninjured party?

This step is a corollary to a constitutional review. Both the United States Supreme Court and Texas Supreme Court have repeatedly held that a plaintiff in a lawsuit must have “constitutional standing” to bring the action. [“Texas has adopted the constitutional standing test employed by the federal courts.” Tex. Bd. Of Chiropractic Examiners v. Tex. Med. Ass’n, 616 S.W.3d 558,567 (Tex. 2018)]. The constitutional minimum standing threshold requires a plaintiff to demonstrate an injury that a court is competent to redress. This threshold is mandated both by separation of powers, which denies courts the power to issue advisory opinions on abstract questions, and the Open Courts provision, which grants access to the courts only to a person “for an injury done him.” According to the Court, the “minimum constitutional elements for standing under Texas and Federal law are (1) an injury in fact, (2) the injury is fairly traceable to the defendant’s conduct, and (3) the injury will be redressed by the requested relief.” Heckman v. Williamson Cty., 369 S.W.3d 137, 150 (Tex. 2012). The courts have further stated that standing requires a showing of specific injury, not generalized harm to the public.

For example, bills that purport to authorize any private individual to enforce a public policy decision by bringing a lawsuit against another individual or entity to recover statutory damages, in our view, fails both a constitutional review (as violating due process protections) and the constitutional standing test. Bills of this type expose businesses and health care providers to the threat (and reality) of serial litigation in every county in the state to redress a generalized harm to the public. They can also seek to enforce a state policy for activities that occur in other jurisdictions, which is inconsistent with principles of federalism and comity. Finally, they involve the courts in social regulation by litigation, which we believe violates separation of powers.

- Does the proposal create a new cause of action?

TCJL generally opposes bills that create new ways to sue. It is also common for these proposals incentivize new litigation by either mandating or permitting the recovery of attorney’s fees. In many cases adequate remedies already exist to redress the alleged harm through the administrative process, common law causes of action, or other enforcement mechanisms. While there may be compelling reasons that might warrant a path to the courthouse, in the vast majority of cases new causes of action simply encourage more litigation, higher litigation costs, and additional liability risks for Texas businesses. Put another way, each new type of lawsuit necessarily creates a cottage industry around a revenue source that did not previously exist. Unfortunately, every dollar spent on litigation is one less dollar for capital investment and job creation. And in most instances, these additional litigation costs flow downhill to taxpayers and consumers in the form of higher taxes, higher costs of goods and services, and less competition in the marketplace. The Legislature did not trigger off the Texas Miracle by creating new causes of action, but by restoring fairness, stability, and predictability to the ones we already had.

- Does the proposal undo prior reforms?

Many of the liability system reforms that contributed to the Texas Miracle occurred in decades past. With the passage of time and the virtually complete turnover in the Legislature since then, the compelling policy reasons supporting those reforms have faded from collective memory. Consequently, we are beginning to see an increasing number of proposals that either contradict or reverse prior reforms. This trend is especially evident in proposals to weaken the 1989 workers’ compensation reforms, which we would argue is the single most important reform that enabled Texas’ economic takeoff, or the 2003 health care liability reforms. We also see it, as we discussed above, in the proliferation of bills expanding existing or imposing new liability on businesses and health care providers. While these proposals may or may not explicitly undo a prior reform, to the extent that they open up new litigation avenues and forms of damages or, as in the workers’ compensation arena, create privileged classes of claimants, they undermine the very principles upon which those reforms were originally based: establishing a fair, stable, and predictable liability system that preserves access to the courts for those with legitimate injuries while guarding against excessive litigation costs and soaring damage awards.

- Does the proposal impose new civil or criminal liability on businesses?

We pose this question when analyzing proposals that expand civil enforcement authority, impose new or expanded administrative or civil penalties, or single out businesses or certain business activities by subjecting them to civil and criminal penalties. Certainly, there may be circumstances under which such punitive treatment is warranted and necessary to protect the health and safety of the public, and our analysis will account for those. But if a proposal targets a specific type of business or occupation for punitive or disparate treatment based on something unrelated (or only tangentially related) to commonly recognized industry or professional standards, we consider such treatment as a government intrusion into the rights of businesses and individuals to manage their affairs as they see fit. Again, the Texas Miracle occurred because government got out of business’s way and encouraged innovation, entrepreneurship, and freedom to grow. Legislation that “goes after” or seeks to make an example of certain businesses or professionals who are otherwise operating within their applicable legal and regulatory parameters does just the opposite.

- Does the proposal interfere with freedom of contract?

Texas law has always affirmed the crucial importance of allowing private persons to contract freely with one another for their common benefit. Only in very limited circumstances have the courts or the Legislature seen fit to interfere with this freedom (for example, contractual indemnity). This freedom likewise extends to the relationship between private employers and their employees, as Texas is both an at-will employment state and a right-to-work state. We take pride in this and businesses flock to Texas because of it. Consequently, bills that insert the state or local governments between private parties, mandate or prohibit specific contract provisions, or tell private businesses how to run their affairs, govern their organizations, or invest their capital must have a compelling justification for doing so and be narrowly tailored so as not to discourage people from doing business in Texas.

We hope that this overview of our process is helpful and constructive. Not everybody is going to agree on everything, but that does not mean that we do not all share the same objective: to take the Texas Miracle to even greater heights of success.

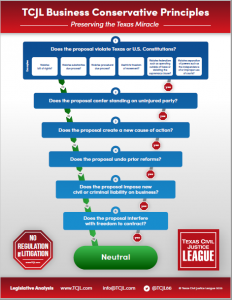

We have devised a graphic “filter” representing our decision tree.

How Will TCJL Statement of Conservative Business Principles Be Applied in Practice?

by Feb 6, 2023

Last week TCJL published its Statement of Conservative Business Principles, together with a “filter” that graphically represents the questions we ask of legislation that may have a significant liability impact on Texas businesses. How will these principles be applied in practice and what will we do with the resulting analysis?

First, which bills will we review? Generally speaking, we look for bills that impose new legal duties and standards on businesses, professionals, and health care providers, particularly those that establish new or expanded causes of action or civil or administrative penalties. Some bills do this explicitly, but others create liability by requiring compliance with ever-increasing levels of regulation and mandates. We will also scrutinize bills that affect the separation and balance of powers between the three branches of government, particularly those that enhance the power of one branch over the others or involves the courts in which matters we believe are better left to the legislature and executive. Currently, we are tracking nearly 400 bills, and the lion’s share of those fall into these categories. We should note that our review will include bills that affect civil and political rights, since businesses as well as individuals enjoy constitutional protections and any erosion of those protections will have a substantial adverse impact on businesses and their employees.

Second, what will we do with our analyses? In the first instance, we will publish them on our website. What happens after that is still a work in progress, but we hope to make our analyses accessible and actionable by cross-referencing them to our tracking list for easy identification and reference. As we noted in the statement, the purpose of this exercise is to raise these questions so that policymakers may consider them during their deliberations. We are by no means the final arbiter—that job belongs to the Legislature, the Governor, and ultimately the courts. But we have learned from the passage of SB 8 in 2021 that if we do not state our views openly and honestly of the potential effects of liability-creating legislation, then we cannot expect policymakers to be either aware of its implications or seek remedies for them.

So what will an analysis look like? HB 645 presents one of the clearest examples we have seen thus far of a bill that raises several concerns based on our filter. As you may recall, this bill creates an SB 8-style no-injury cause of action by any person against a financial institution that uses so-called “value-based criteria” in its business practices. It contains a broad definition of “value-based criteria,” but the bill is generally focused on “ESG,” i.e., social credit, environmental, and social governance scoring. A prevailing claimant shall recover at least $100,000 in statutory damages, plus costs and attorney’s fees, as well as injunctive relief. Let’s see what the filter tells us about this bill.

- Does the proposal violate the Texas or U.S. Constitutions?

In our view, the answer is yes in at least three ways. First, the bill may violate a private business’s free speech and association rights under the federal and state constitutions. The problem lies in the vague, overbroad definition of “value-based criteria” and its application to the institution’s “business practices.” As we know from SCOTUS’s decision in Citizens United v. Federal Election Commission, 558 U.S. 310 (2010), corporations and other associations have the same speech rights under the First Amendment as individuals, meaning that courts will apply a strict scrutiny standard to any statute that purports to limit that speech. Under HB 645, a corporation would be subject to theoretically unlimited punitive damages (the caps in Chapter 41, CPRC, do not apply) for conducting its “business” in a way that may be construed to “discriminate against, advocate for, or give disparate treatment to a person using value-based criteria.” Presumably, this can mean anything from either loaning money or not loaning money to certain individuals or organizations to having corporate policies that respond to shareholder, investor, and customer interests and demands. While Citizens United struck down federal and state bans of independent campaign expenditures by corporations, there is, in our view, no meaningful distinction between the speech acts involved in that case and those that would be regulated by HB 645. As SCOTUS stated, “The First Amendment bars attempts to disfavor certain subjects or viewpoints, as well as restrictions distinguishing among different speakers, allowing speech by some but not by others.” 558 U.S. at 340. HB 645 does both.

Additionally, we believe a strong argument can be made that HB 645 (1) violates procedural due process under the Fifth and Fourteenth Amendments, (2) impermissibly extends Texas law to activities wholly conducted in other states and nations and not involving Texas citizens, and (3) violates the separation of powers. Part of the analysis is given below in the discussion of constitutional standing, which rests on separation of powers and the constitutional requirement that a person suffer a concrete, particularized injury in order to have standing to sue. Beyond the standing problem, however, the bill imposes a quasi-criminal penalty (unlimited punitive damages) that may be recovered without a showing of actual harm. This means that the defendant business can only escape liability by proving a negative, that is, the business did not violate a vague and overly broad standard subjecting it to such liability. That may well be a due process violation. To the extent that the bill punishes conduct that occurs wholly outside of Texas, it could also run afoul of the due process clause and, though offering a high hurdle, the dormant commerce clause on the basis that it attempts the direct regulation of business activities occurring far from Texas. Finally, we believe that the private enforcement mechanism the bill borrows from SB 8 puts the courts squarely in the business of social and economic regulation, thus violating separation of powers.

- Does the proposal confer standing on an uninjured party?

Yes. HB 645 authorizes “any person” to sue a business or financial institution. Quoting In re Abbott, 601 S.W.3d 802, 807 (Tex. 2020), “The Texas standing doctrine derives from the Texas Constitution’s provision for separation of powers among the branches of government, which denies the judiciary the authority to decide issues in the abstract, and from the open courts provision, which provides court access only to a ‘person for an injury done him.’” The harm requirement for purposes of determining constitutional standing requires “actual injury, as opposed to one that is general or hypothetical. Thus, as a general rule, to have standing an individual must demonstrate a particularized interest in a conflict distinct from that sustained by the public at large.” South Texas Water Authority v. Lomas, 223 S.W.3d 304, 307 (Tex. 2007).

Texas constitutional standing doctrine closely follows federal law. According to the United States Supreme Court, standing requires plaintiffs to “demonstrate, among other things that they have suffered a concrete harm. No concrete harm, no standing. Central to assessing concreteness is whether the asserted harm has a ‘close relationship’ to a harm traditionally recognized as providing a basis for a lawsuit in American courts—such as physical harm, monetary harm, or various intangible harms including . . . reputational harm.” TransUnion LLC v. Ramirez, 141 S.Ct. 2190, 2200 (2021). Although HB 645 purports to grant standing to any person to sue . . . , “courts’ constitutional jurisdiction cannot be enlarged by statute.” In re Allcat Claims Serv. L.P., 356 S.W.3d 455, 462 (Tex. 2011). The United States Supreme Court recently echoed this longstanding rule. “Congress may ‘elevate to the status of legally cognizable injuries concrete, de facto injuries that were previously inadequate in law. . . . But even though ‘Congress may “elevate” harms that “exist” in the real world before Congress recognized them to actionable legal status, it may not simply enact an injury into existence, using its lawmaking power to transform something that is not remotely harmful into something that is. . . . [I]f the law of Article III did not require plaintiffs to demonstrate a ‘concrete harm,’ Congress could authorize virtually any citizen to bring a statutory damages suit against virtually any defendant who violated virtually any federal law.’” Transunion LLC v. Ramirez, 141 S.Ct. 2204-2208.

HB 645, in our view, clearly violates the constitutional standing doctrine because it allows any person to sue a business or financial institution without a showing of concrete, particularized harm.

- Does the proposal create a new cause of action?

Yes, as discussed above.

- Does the proposal undo prior reforms?

Yes. HB 645 lifts the cap on punitive damages as it applies to the bill’s new cause of action.

- Does the proposal impose new civil or criminal liability on business?

Yes, as discussed above.

- Does the proposal interfere with freedom of contract?

Yes. The bill is designed to have a chilling effect on a business’s or financial institution’s right to contract with employees, investors, partners, vendors, and customers and to direct their lawful business practices as they, their shareholders, and officers and directors see fit, based on conduct that is constitutionally protected.

HB 645 demonstrates how our categories of analysis may overlap when constitutional issues interact with the expansion of liability exposure. Because the bill raises so many constitutional due process and standing concerns, those concerns dominate the analysis in this case. Discussion of most other bills will likely fall within questions 3-6. In any event, as we refine the process, we will make every effort to make it as useful and informative as possible. Given the unusually large number of bills creating new liability exposure filed so far, we will do our best to make our analyses available in a timely way. And, as always, we are cognizant that our reading of these bills, while informed by our understanding of the law and longtime experience in the civil justice arena, represents a perspective that privileges the liberty of businesses and health care providers to make decisions based on the best interests of their customers, patients, employees, shareholders, and investors. Texas is winning the international economic competition in large part because it stays out of business’s business. We hope that providing information about proposed legislation that steps over that line will help keep it that way.